In the past few months, Whole Foods has received more press than it did in the prior few years with its purchased by Amazon, empty shelves because of a new “order-to-shelf” inventory system, employees in tears due to Amazon’s employee “scorecards” and stringent stocking requirements, and now Amazon’s delivery service.

No doubt, Amazon’s goal is to improve efficiencies, optimize shelf space, quickly turn inventory, and reap higher profits. Sounds good from an operational point-of-view, but possible not beneficial for customers.

Often called “Whole Paycheck,” Whole Foods’ niche is their vast selection of foods and products, focused on healthy living and a commitment to being “America’s Healthiest Grocery Store.” Customers know they’ll find what they need, from vibrant produce, flowers, and potted plants to a breadth of gourmet-prepared organic, natural, and gluten free foods, baked goods, sustainable seafood, variety of free range, pasture raised, local and heritage meats (from beef to bison, goose, duck, pheasant, Cornish game hens, quail and goat), wines and beer, and high-quality beauty, hair and body care products.

Despite their reputation for having an unmatched variety of high-quality, often local and unusual one-off products, Amazon is reportedly pruning the products they offer, making space for more national brands. The kind you’d find in most neighborhood stores.

In addition, Amazon is expected to lower prices to attract customers from lower-priced grocery stores. In the past, when Amazon entered a new industry, the stock valuation of the sector’s largest companies declined as investors anticipated Amazon reducing profits to zero to gain market share.

In the long-run their tactics could backfire, reducing customer loyalty. On the other hand, they could upset the “apple cart,” redefining the grocery shopping experience by forcing competitors to cut costs by reducing staff, purging products with low sales margins, closing or selling less profitable stores, or eliminating cost centers, like in-store bakeries, catering departments, and florists.

While The Daily Meal ranks Whole Foods as the number one grocery store in 2017, many of the grocery stores on the list aren’t competing on price, but access to local, regional, and unusual products, customer service, breadth of specialty or ethnic foods, and store atmosphere or experience (check out the inside of Stew Leonard’s or Jungle Jim’s).

Whole Foods’ current challenge of empty shelves, grumpy employees, and reduction in the types of products they’ve historically stocked may not continue to endear customers.

The number two grocery store on The Daily Meal list is Trader Joe’s, which are relatively small stores with 80 percent of their products being Trader Joe’s house brand labels. The appeal of Trader Joe’s is their ability to infuse funky and fun into everything they do from their black and white flyers with vintage clipart, amusing stories and recipes to their friendly, highly knowledgeable employees clad in Hawaiian shirts to the way they name and brand everything, such as their frozen ethnic foods: Trader Jose’s (Mexican food), Trader Ming’s (Chinese food), Trader Giotto’s (Italian food), etc.

In another article The Daily Meal highlights the best grocery stores in every state. Many of these stores are focused on enhancing the shopping experience with unique displays, bins of stunning local and organic produce, food demonstrations and tasting stations, shelves of hard-to-find items, and in-store restaurants and coffee bars.

In another article The Daily Meal highlights the best grocery stores in every state. Many of these stores are focused on enhancing the shopping experience with unique displays, bins of stunning local and organic produce, food demonstrations and tasting stations, shelves of hard-to-find items, and in-store restaurants and coffee bars.

According to the Marketforce Information “US Grocery 2017 Consumer Experiences & Competitive Benchmarks,” over 1 in 10 consumers are dissatisfied with their last grocery experience. Based on their research, the three grocery stores with the highest brand loyalty are Public Super Markets (77.4%), Wegmans (77.0%) and Trader Joe’s (75.6%). Whole Foods have 60.7% brand loyalty, below WinCo Food (employee-owned, no-frills, ultra-low cost) and Costco (warehouse quantity and prices).

While many of the stores cited by The Daily Meal have dozens and sometimes hundreds of locations, few are cookie-cutter. Each is tailored to the needs of its communities with strong connections to local farmers, ranchers, and other food suppliers, and partnerships with non-profits.

Here’s a sampling of some of the top-rated grocery stores in various states: Sprouts (Arizona), Trader Joes (California), Stew Leonard’s (Connecticut), Janssen’s Market (Delaware), The Fresh Market (Indiana). MOM’s Organic (Maryland), Rainbow Co-op (Mississippi), Open Harvest Grocery Co-op (Nebraska), La Montanita Co-op (New Mexico), Wegmans (New York), Jungle Jim’s International Market (Ohio), New Seasons (Oregon), H-E-B (Texas), Ellwood Thompson’s (Virginia), and PCC Market (Washington).

It’ll be interesting to see how consumers respond to changes within Whole Foods, and whether the stores will gain or lose market share. In addition, while Amazon has mastered the stocking and distribution of products in warehouses, will they have the same success in stocking physical stores, and responding to customers’ needs while they’re fuming at the cash register or looking at pillaged shelves.

Here’s another thought…

Last week, Amazon announced certain members of their Prime subscription program can select foods from the Whole Foods website, and then have them delivered to their homes within two hours. The program debuts in several neighborhoods in Austin, Dallas, Virginia Beach, and Cincinnati, and will be free for orders over $35, and $4.99 for smaller purchases. Expedited, one-hour delivery will cost $7.99.

Other stores, such as Fred Meyer (part of Kroger) have experimented with “click and collect” and delivery services. In the case of Fred Meyer, you can order your groceries online, then drive to a specific parking area, where your groceries will be wheeled out to you. In 2017, according to Marketforce Information, 8.9% of consumers have tried “click and collect” services, which is double the rate from 2016.

Harried consumers are eager to embrace technologies that make it easier to conduct their lives from preparing dinner to buying necessities. I can’t help wondering, however, if America is going to start to be fractured into those supporting time-saving services and technologies by stocking, picking, and bagging products off shelves, and then delivering them, and those who can afford to purchase premium products and services.

The growth of Walmart, resale stores like Goodwill and Value Village, and drugstore chains like Walgreens, Rite Aide, and CVS Health that sell staple goods, common household goods, and also have affordable in-store health clinics is partially fueled by the growing lower-class who struggle to put food-on-the-table, along with pay for other obligatory expenses from shelter to utilities, transportation, basic healthcare, and warm clothing.

According to the United Nations, forty million Americans, one in eight, live in poverty, nearly half in deep poverty. The United States has the highest child poverty rate – 25 percent – in the developed world with one in four children having food insecurities.

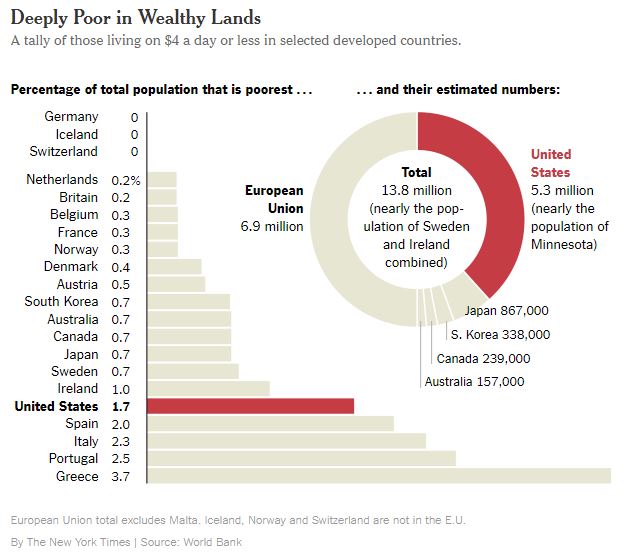

Approximately 1.7 percent of the U.S. population, 5.3 million people, live on $4 or less per day according to the World Bank in an article published in the New York Times, “The U.S. Can No Longer Hide from Its Deep Poverty Problem.” The total number of deep poor in the European Union is 6.9 million. You don’t need a calculator to realize there are 1.6 million fewer people living in deep poverty in the United States than in 28 European countries, including those with high refugee populations.

Approximately 1.7 percent of the U.S. population, 5.3 million people, live on $4 or less per day according to the World Bank in an article published in the New York Times, “The U.S. Can No Longer Hide from Its Deep Poverty Problem.” The total number of deep poor in the European Union is 6.9 million. You don’t need a calculator to realize there are 1.6 million fewer people living in deep poverty in the United States than in 28 European countries, including those with high refugee populations.

Flat wages, wage inequities, loss of higher paying jobs, such as in manufacturing, and the evolution of the gig economy coupled with declining social mobility have contributed to the rise of poverty and the working poor in America.

No doubt, Amazon has enabled entrepreneurs and suppliers of niche and esoteric products along with traditional brick-and-mortar companies to connect with online buyers and grow their businesses. According to an Amazon press release, more than 100,000 entrepreneurs achieved over $100,000 in sales selling on Amazon in 2016.

The company has also contributed to the loss of retail jobs, which have partially been replaced by sweat-labor seasonal and full-time work in warehouses, along with lower-paying delivery positions.

There’s no doubt, Amazon has “upset the apple cart” when it comes to the way people purchase goods. Today, nearly $1 of every $2 spent online flows through Amazon, and its third-party retailers. Time will tell if their aggressive business strategies will reshape the grocery industry.

I’ve got to style my personal passion for ones kindness supplying help to be able to the individuals that will have guidance on this particular crucial make any difference.